Hello, and Happy New Year. In this newsletter I’ve tried to give the best estimate for the housing and financial scene for 2018 and included some information on protecting your personal financial information.

Hello, and Happy New Year. In this newsletter I’ve tried to give the best estimate for the housing and financial scene for 2018 and included some information on protecting your personal financial information.

With the economy and employment strong, the national housing market is expected to have a good year. However, in higher-priced cities the increase in home prices is expected to moderate compared to 2017. According to the National Association of Realtors, a price appreciation of about 3% is expected in the Los Angeles/Orange county market—a normal rate of growth. One of the reasons for the slowdown is the lack of affordable housing. (Riverside-San Bernardino, a more affordable area, is expected to appreciate 5.7%.)

Population growth in the area should support price levels. This would suggest that if you are looking for a home, waiting for prices to drop would not be a successful strategy. Additionally, the prediction is that mortgage rates will rise (hopefully, slowly) throughout the year – so buying sooner is better than waiting, if your finances would allow.

Similarly, if you are looking to refinance, it would be better to do this sooner rather than later.

I offer free analysis of your situation to see if a home purchase or refinance would make sense.

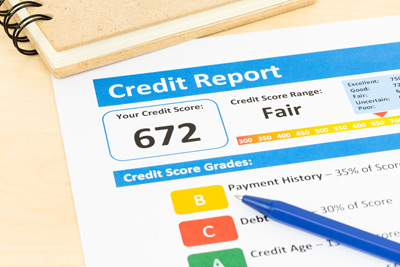

Protecting Your Credit Information

You probably heard that Equifax, one of the three major credit agencies in the country, announced a major security breach in their systems. The breach revealed the personal financing information of about 143 million Americans, putting them at risk for fraud and identity theft.

You probably heard that Equifax, one of the three major credit agencies in the country, announced a major security breach in their systems. The breach revealed the personal financing information of about 143 million Americans, putting them at risk for fraud and identity theft.

If you didn’t know, one option to protect your information is to use a “credit freeze.” A credit freeze is a tool that lets a consumer restrict access to their credit. A credit freeze can cost from$3-$10. Equifax will not charge for a freeze for those affected by the 2017 security breach. But, hurry, the deadline for a “free” freeze is January 31, 2018. Their phone number is: 800-349-9960, or visit them online at freeze.equifax.com.

Some things to know:

- Credit freezes will stop someone from opening a new account in your name, but not from making unauthorized charges on existing accounts.

- You can unfreeze your account if you want to open a new account, but freezing and unfreezing can incur a charge (unfortunately).

- Freezing your Equifax credit does not freeze the other two bureaus (Transunion and Experian). If you have concerns you need to contact these bureaus, also.

- You should monitor your charges to catch unauthorized charges and notify your credit card company immediately.

- You can get a free credit report from each bureau once a year at annualcreditreport.com. With these you can see if any new accounts were opened.

- An alternative to a freeze is a credit alert which will not lock your credit, but will tell anyone who runs your credit that they should check with you before opening a new account. These expire after 90 days, but can be renewed.

Have a great 2018 and be sure to contact me if you have any real estate financing questions.

David Kutner

The Friendly Lender